Offshore Bank Account Xexon

Open a new checking account by Jan. 24 and transfer $500,000 or more within the first 45 days in new-to-bank money or securities, and a $3,000 bonus will appear in your account within 40 days.

BANK ACCOUNT Storyboard by ed6b18b9

BMO checking: Up to $400 bonus offer Chase Secure Banking℠: $100 bonus offer Chase Total Checking®: $200 bonus offer

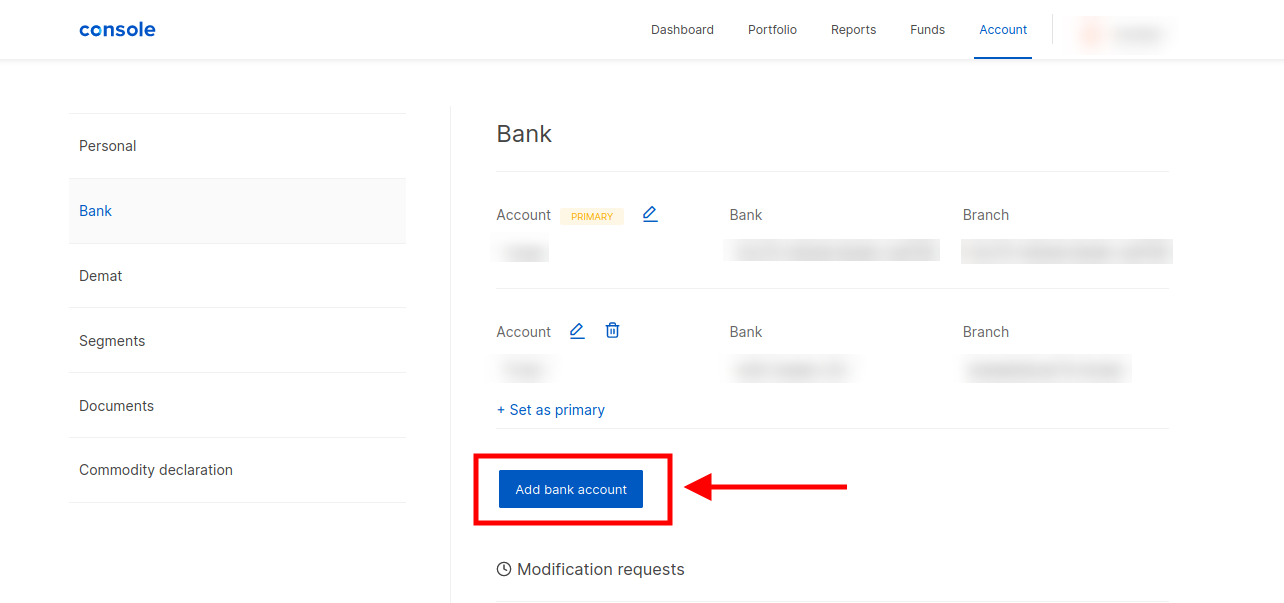

How To Change Bank Account In The Zerodha App?

High-yield savings accounts are savings accounts that usually reward savers with a higher rate of interest than traditional savings accounts. It's important to keep in mind that interest rates.

Bank Account Free of Charge Creative Commons Chalkboard image

On high-yield savings accounts with a minimum opening deposit of $25,000, the highest rate offered today is 4.89%. You'll be in good shape if you can find an account offering a rate close to 4..

All the information you need on how to open a bank account in Japan

Open Account. $50-$300 Expires June 30, 2024 More Info. New customers can earn a $300 bonus for opening a new SoFi Checking and Savings account and receiving a total of $5,000+ in qualifying direct deposits within the specified evaluation period; receive $1,000 - $4,999 in qualifying direct deposits to earn a $50 bonus.

Bank Account Bank Account Credit with an… Flickr

Discover Bank Online Savings Account : Best for strong APY Fifth Third Momentum Checking : Best for no monthly maintenance fees Citi Priority : Best for high balances Huntington Perks Checking.

How to close the bank account permanently FinnByte

This account's perks include: Up to 15% cash back on eligible purchases from local businesses with your SoFi debit card. 0.50% APY on checking balances. 1.20% or 4.60% APY on savings balances.

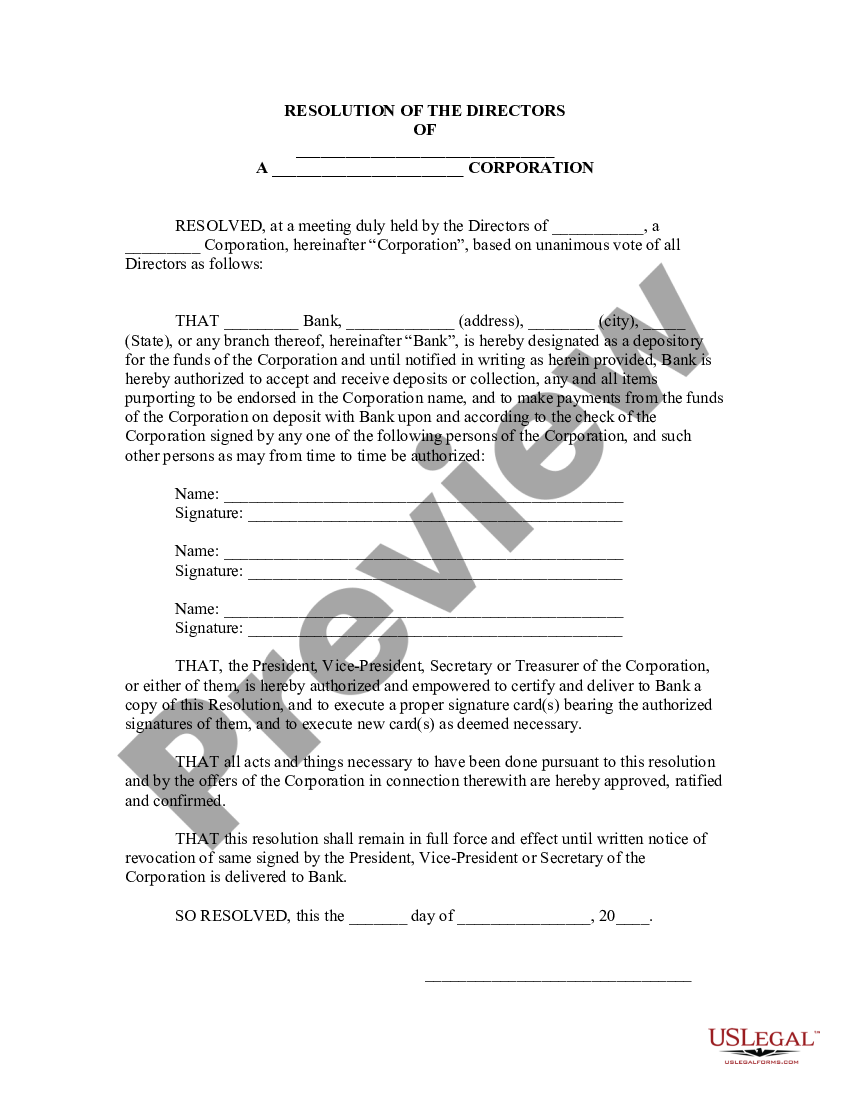

West Virginia Open a Bank Account Corporate Resolutions Forms Bank Account Corporate US

SoFi Checking and Savings Account: Up to 4.60% APY. Citizens Access® Savings: 4.50% APY. See below to learn why we picked each account, including its pros and cons, and to access individual bank.

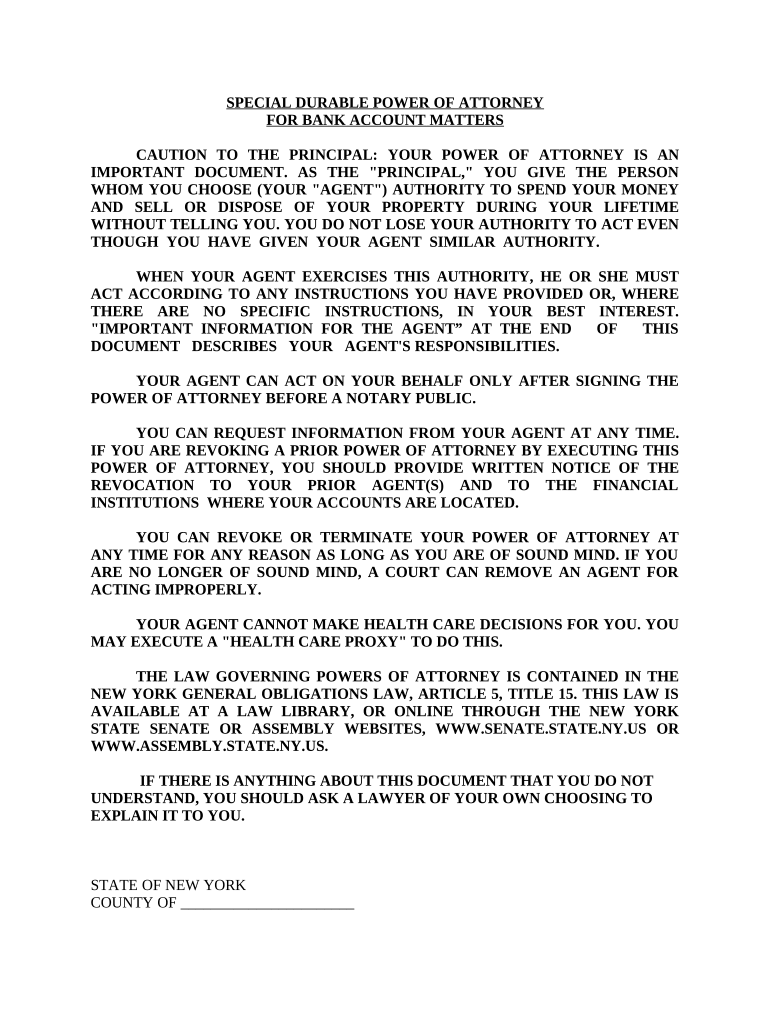

bank account pdf Doc Template pdfFiller

Perks. Earn up to $4,000 when you open a new HSBC Premier checking account and complete qualifying activities (offer ends 3/27/24). Option to waive monthly fees* with an eligible direct deposit or.

Bank तुमचेही आहे सैलरी किंवा सेविंग अकाउंट तर जाणून घ्या दोन्हीतील फरक, मिनिमम बैलेंस व ब्याज

Step 5. Fund the account. If your chosen bank or credit union requires a minimum deposit to open a new savings account, you'll need to fund it with a check, cash, credit or debit card payment.

Bank account system in C using File handling

Bankrate's picks for the best consumer bank account bonuses in December 2023 Best checking account bonuses Chase (Private Client): $3,000 bonus Wells Fargo: $2,500 bonus Citibank: Up to.

Bank Account Basics FAQ Stack Your Dollars

Bankrate's picks for the best consumer bank account bonuses in January 2024 Best checking account bonuses Chase (Private Client): $3,000 bonus Continue reading Wells Fargo: $2,500 bonus.

5 Things to Consider When Opening a Bank Account For Your Photography Business — DC Wedding and

The Best Bank Account Bonuses for 2024 Best Overall: Associated Bank Best for a Modest Balance: Chase Best for Building a Savings Habit: Alliant Credit Union Best Overall : Associated Bank.

Bank Account ಇಲ್ಲಾಂದ್ರು ನೋಟ್ ಚೇಂಜ್!

Earn up to a $3,000 bonus when you open a new Chase Private Client Checking℠ account, transfer qualifying funds into a combination of eligible accounts within the first 45 days, and maintain.

What should I do if I see “Rejected” bank account status? Agoda Homes Host Help Center

Best Bank Account Bonuses - January 2024 By Marcie Geffner | Edited by Austin Cole | Reviewed by Mark Evitt | Updated: 1/2/2024 You can get a bonus for opening a checking or savings account,.

GitHub physicsmagician/BankAccount This program allows you to use a bank account interface

FinCEN's analysis found that approximately 1.6 million reports (42% of the reports filed that year) related to identity—indicating $212 billion in suspicious activity. "This report reveals the existence of significant identity-related exploitations through a large variety of schemes," said FinCEN Director Andrea Gacki.