Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

What is a Triple Bottom Pattern? The triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. Think of this pattern like a trusty ally that nudges you, suggesting, "The market's tide might be turning."

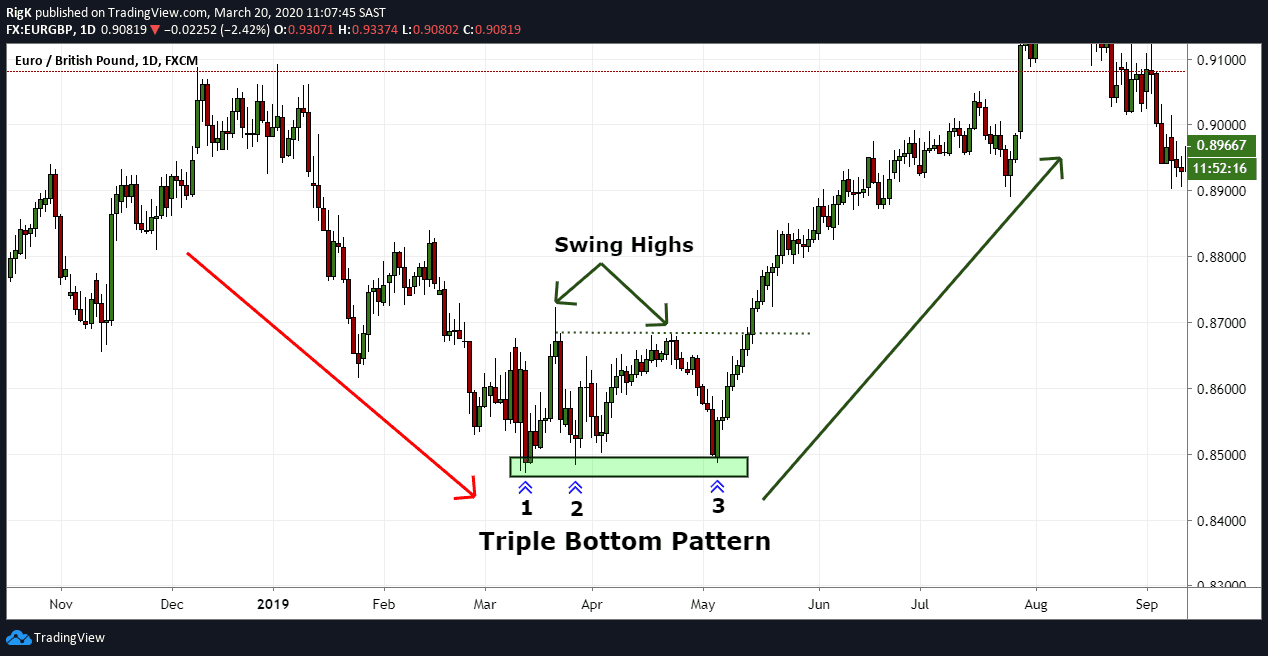

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Chart Pattern (The Essential Guide) Discover Professional Price Action Strategies That Work So You Can Profit In Bull & Bear Markets—Without Indicators, News, Or Opinions Get Your Copy Now (Risk-Free) Triple Bottom Chart Pattern (The Essential Guide) Last Updated: June 29, 2023 By Jet Toyco

The Triple Bottom Candlestick Pattern ThinkMarkets AU

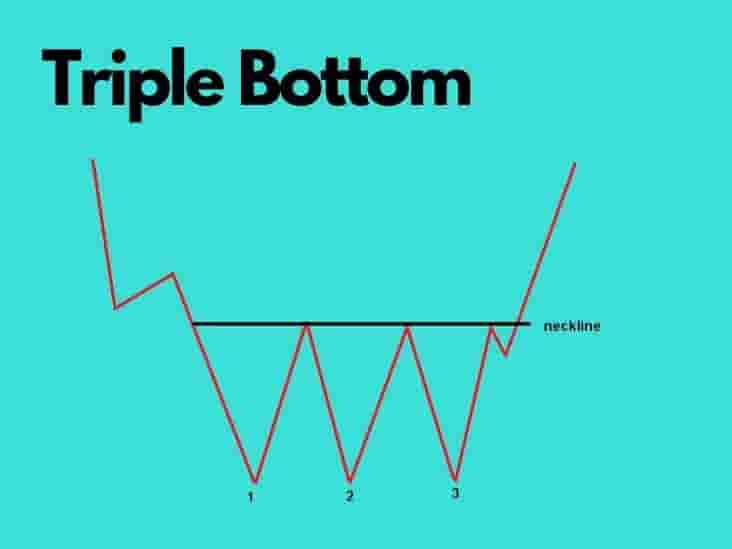

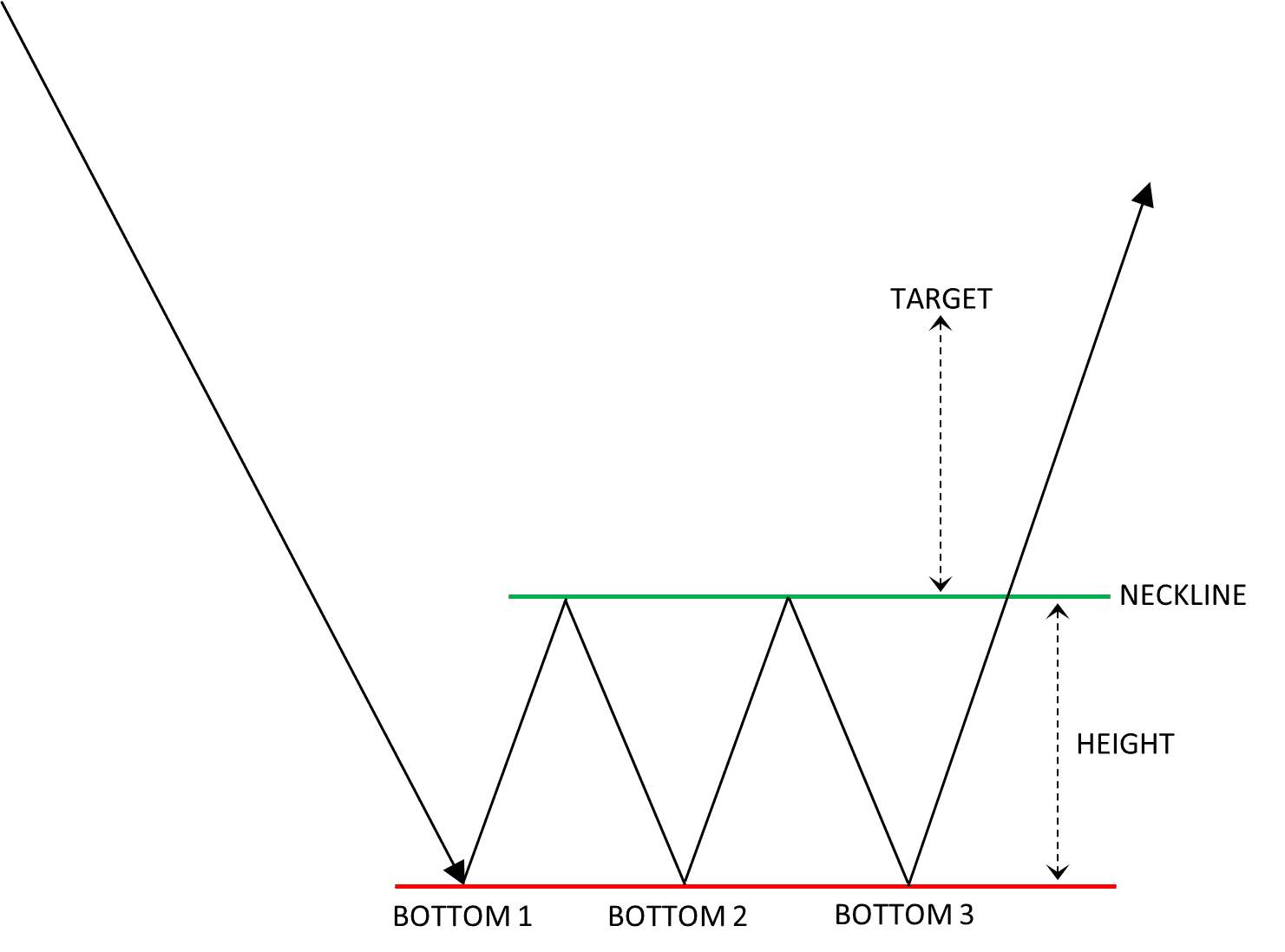

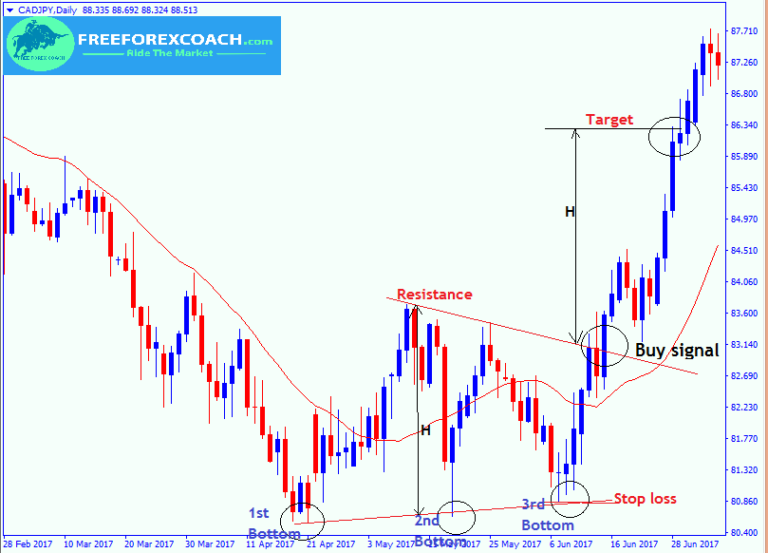

A triple bottom pattern in trading is a reversal chart pattern in which price forms three equal bottoms consecutively and after neckline/resistance breakout, price changes bearish trend into a bullish trend. It is the most widely used chart pattern in forex/stocks trading and the most basic pattern in technical analysis.

Triple Bottom Chart Pattern Definition With Examples

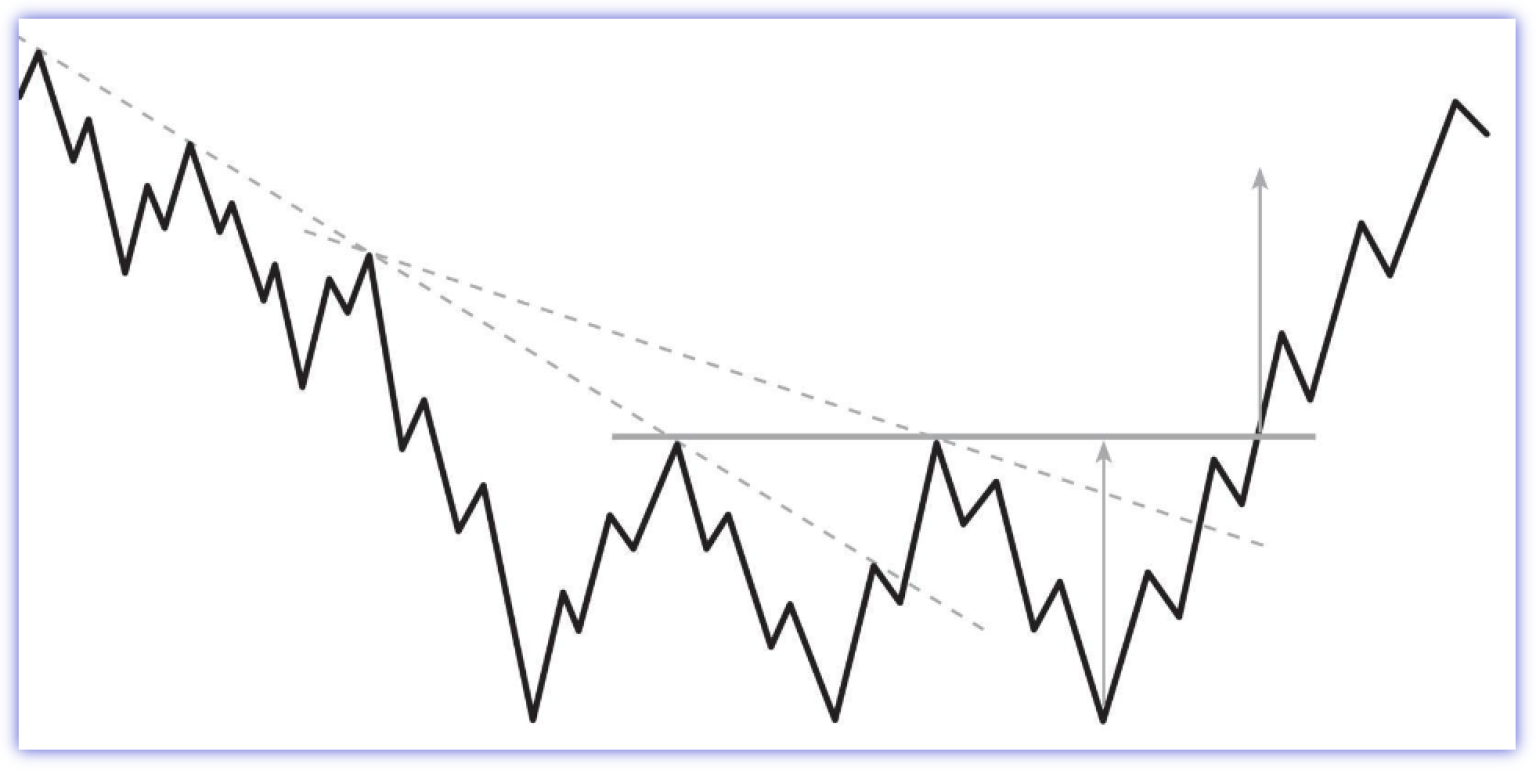

The triple bottom pattern is a key element in technical analysis, often signaling a potential reversal of a downtrend in financial markets. This bullish chart pattern emerges when an asset's price reaches three equal lows, followed by a breakout above the resistance level. Used by both novice and experienced traders, the triple bottom pattern.

Triple Bottom Pattern Explanation and Examples

The triple bottom pattern is a bullish reversal chart pattern that is formed after a downward trend and is composed of three consecutive bottoms and a resistance neckline. Following the breakout, there's often a trend reversal and a bullish trend begin.

How To Trade Triple Bottom Chart Pattern TradingAxe

The triple bottom pattern can only be used as a reference for buy entries because it shows a bullish reversal and cannot be used as a reference for sell entries. How to Use the Triple Bottom Pattern. Regarding how to use the triple bottom pattern in trading, there are several strategies that traders must pay attention to, namely the following: 1.

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

A triple bottom is a reversal pattern, meaning that it is a signal of change in the current direction of a market or trend. It is one of the three major reversal patterns (along with a double bottom and head and shoulders, which are both reversal patterns as well).

How to Read the Triple Bottom Pattern? by FAMEEX Research Medium

Chart patterns are extremely crucial for price action traders. They serve as a useful tool for predicting future price trajectories, and the triple bottom pattern is one of the most popular bullish reversal patterns.. Much like its twin, the triple top pattern, it is popular because its reliable, precise, and produces traders a respectable average profit.

How to Trade with Triple Bottom Pattern Strategy • InvestLuck

A triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. While not often.

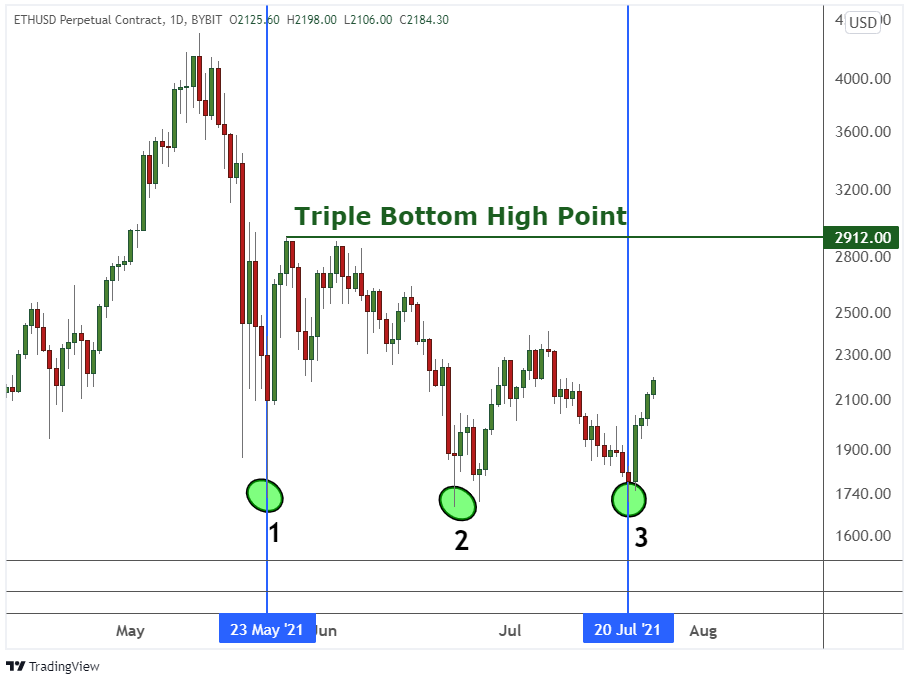

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

The triple bottom pattern is one of the bullish reversal chart patterns in technical analysis. It is characterized by three consecutive swing lows that occur nearly at the same price level followed by a breakout of the resistance level.

Triple Bottom Pattern, Triple Bottom Chart Pattern

What is the Triple Bottom pattern? The Triple Bottom compromises three bottoms or troughs in a downtrend and marks the change in trend from bearish to bullish. The formation of the Triple Bottom takes place when the price creates three troughs at an equal level. These troughs form a support level.

Triple Bottom Pattern Technical Resources

Triple bottom patterns are a bullish pattern. It consists of three valleys or support levels. After the first valley is formed, the price rises quickly or gradually. After that, the price moves back down to the first valley level, and it holds that first support level, thus creating a double bottom.

The Triple Bottom Candlestick Pattern ThinkMarkets AU

The triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. It involves monitoring price action to find a distinct pattern before the price launches higher. The "triple bottom" name comes from the chart's shape before the price spikes.

The Triple Bottom Pattern is a bullish chart pattern. It occurs when there is a pattern of

What Is a Triple Bottom Pattern? A triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. It appears rarely, but it always warrants consideration, as it is a strong signal for a significant uptrend in price.

Triple Bottom Pattern In Forex Identify & Trade Free Forex Coach

A triple-top chart pattern is a bearish reversal chart pattern that is formed after an uptrend. This pattern is formed with three peaks above a support level/neckline. The first peak is formed after a strong uptrend and then retrace back to the neckline.

Chart Pattern Triple Bottom — TradingView

The triple bottom is a bullish reversal candlestick pattern that signals a change in the trend direction. Learn more with ThinkMarkets here. | EN InternationalAustraliaSouth AfricaChinese SimplifiedUnited KingdomNew ZealandEuropeJapan Support Deposit Funds Partner Portal ThinkInvest International Search Support Deposit Funds Trading Log In