Engulfing Candlestick Patterns (Types, Examples & How to Trade)

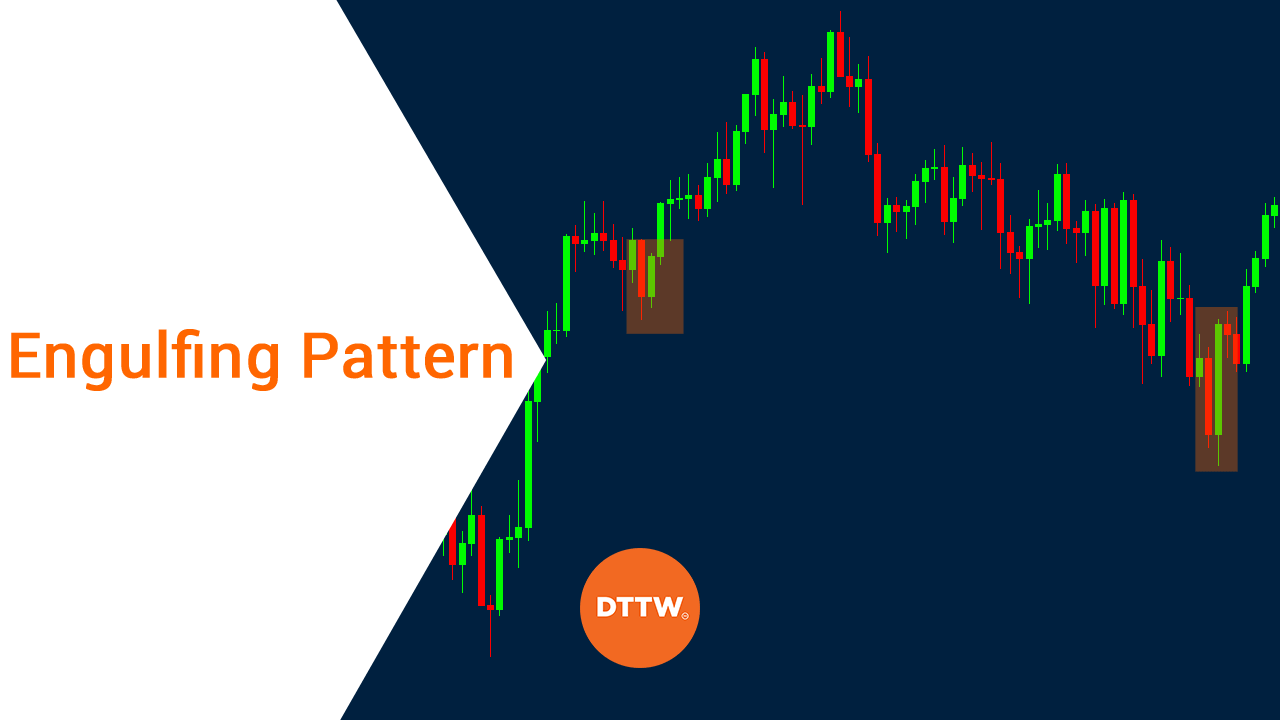

It is a two-candle formation wherein the second candle fully engulfs the previous candle including the wicks. The Engulfing candlestick pattern has a reversal potential on the chart. In this manner, we recognize two types of Engulfing candle patterns: Bearish Engulfing: It could be found at the end of bullish trends.

How to Use a Bullish Engulfing Candle to Trade Entries Bybit Learn

Engulfing candles tend to signal a reversal of the current trend in the market. This specific pattern involves two candles with the latter candle 'engulfing' the entire body of the candle.

Difference between Candlestick Pattern and Chart Pattern

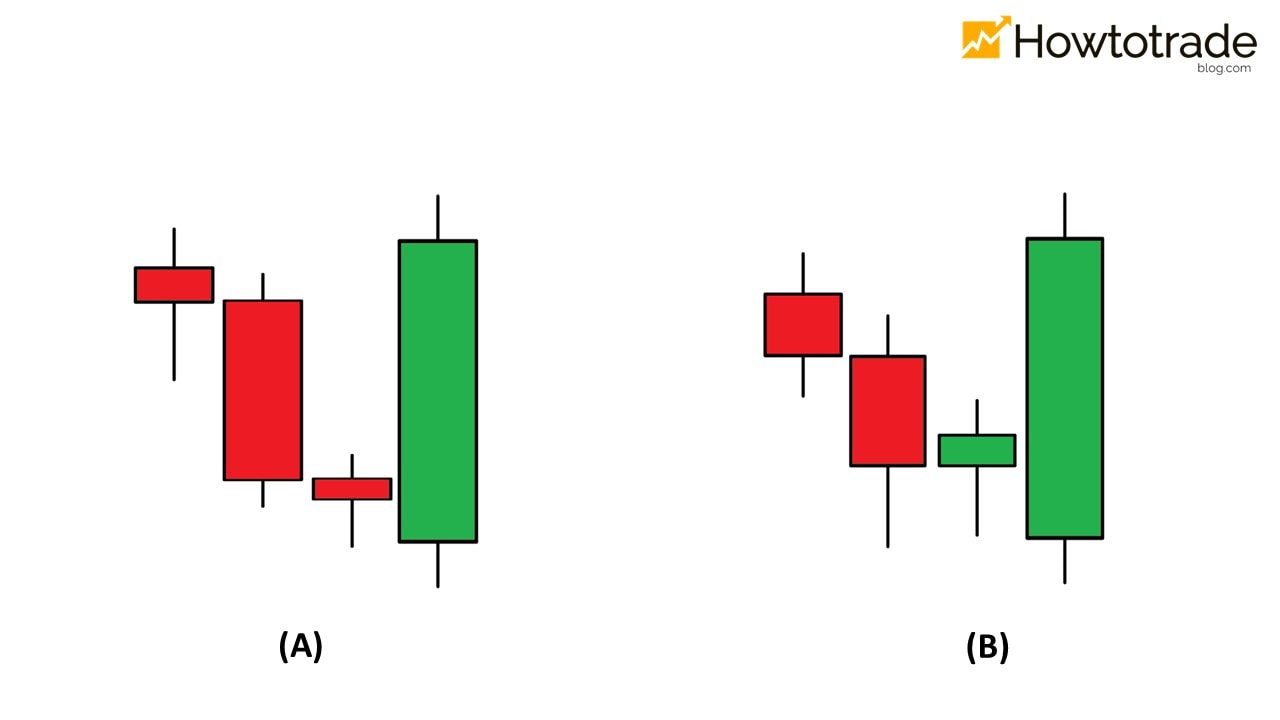

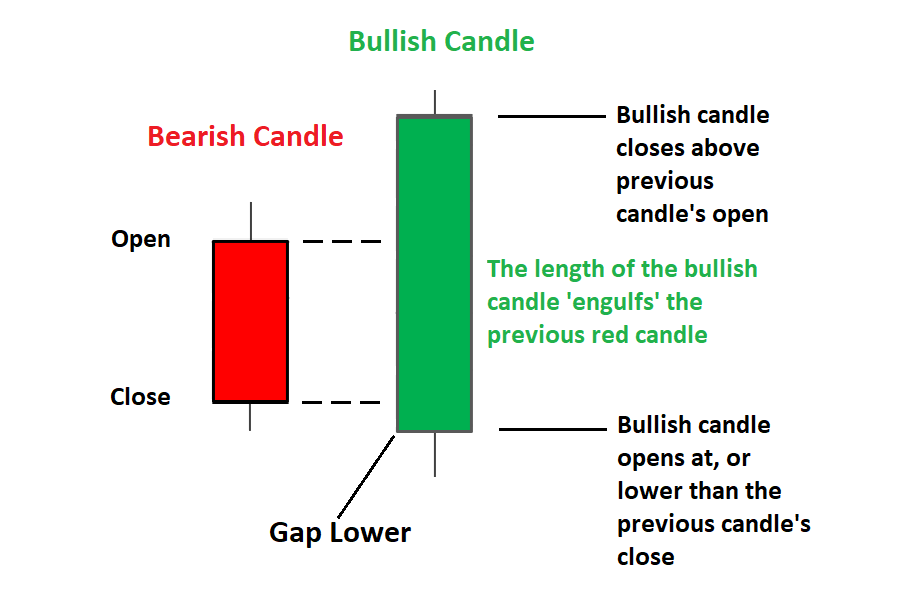

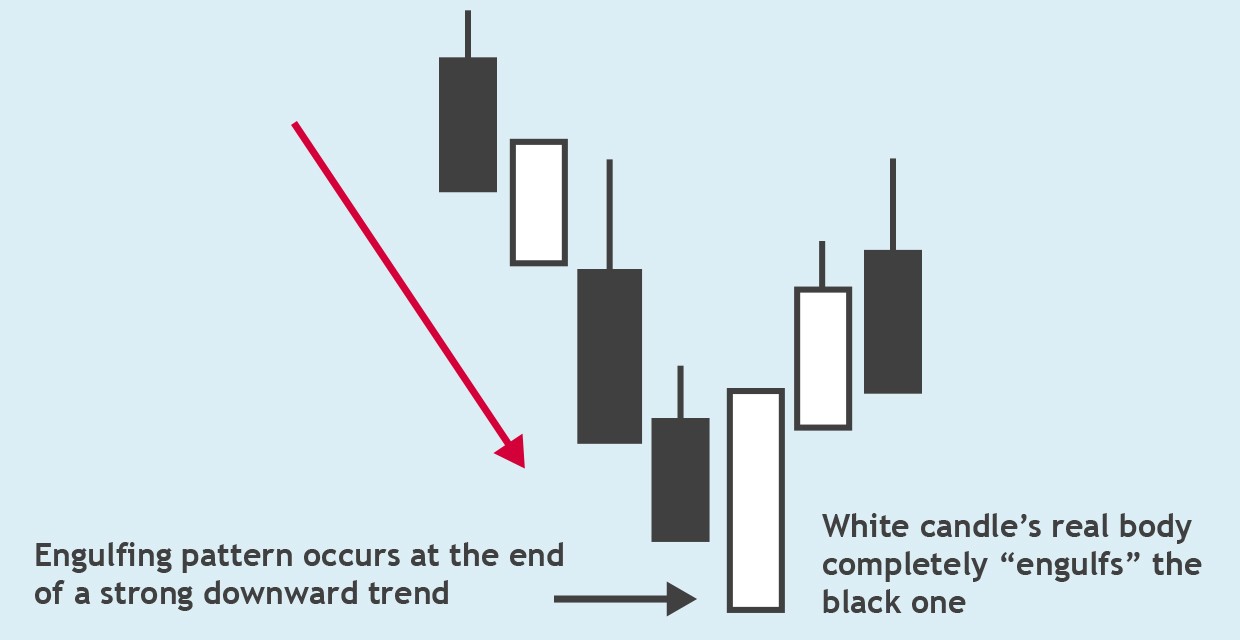

A bullish engulfing candlestick pattern occurs at the end of a downtrend. It consists of two candles, with the first candle having a relatively small body and short shadows, also known as wicks. The second candle, on the other hand, has longer wicks and a real body that engulfs the body of the previous candle. As seen in the illustration above.

Bullish Engulfing Candlestick Pattern & How To Trade Forex With It

Engulfing candlestick patterns are reversal structures made of two candles, in which the second candle engulfs (wraps) the first candle. There are two types of engulfing patterns: bullish that forms at the bottom of a trend and bearish establishing at the top. In an engulfing pattern, the two candles must be opposite in color.

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

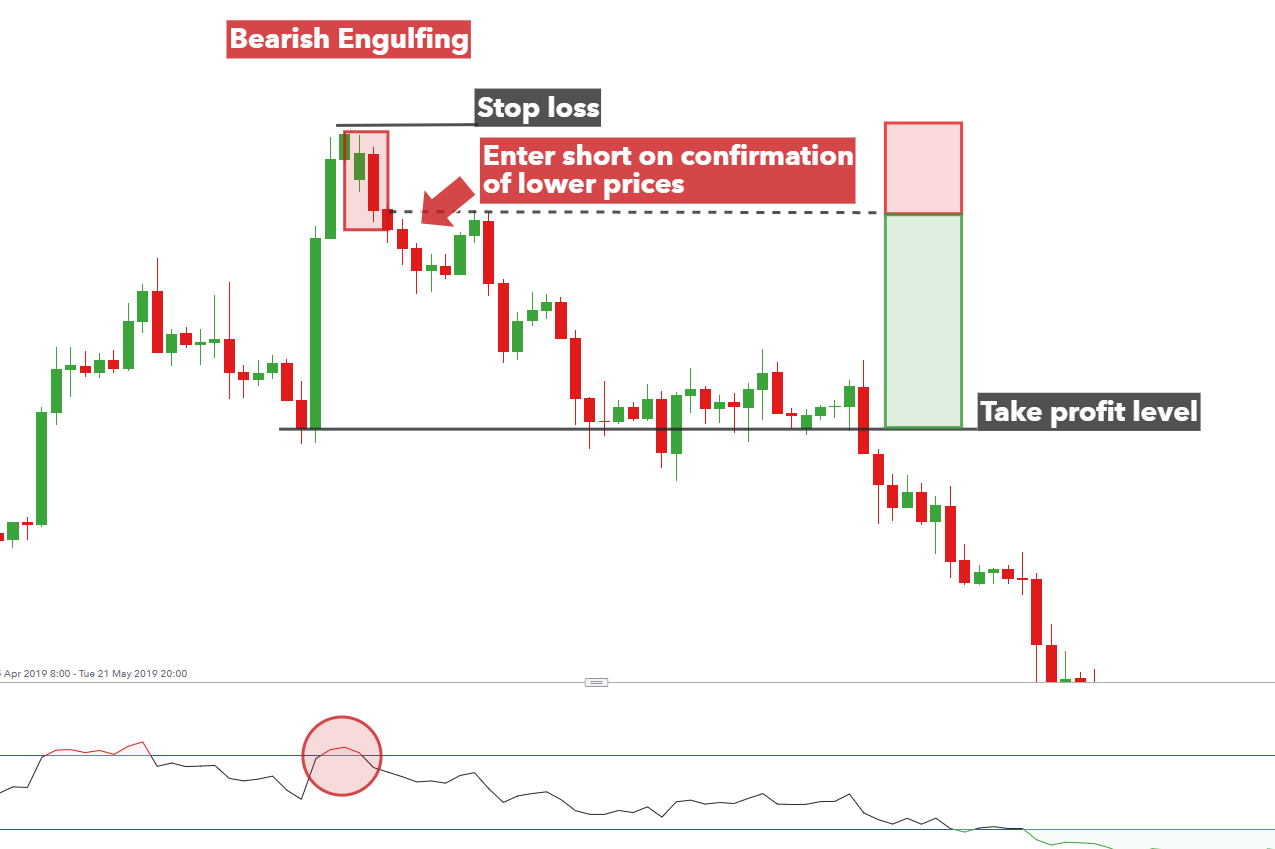

Bearish Engulfing Pattern: A bearish engulfing pattern is a chart pattern that consists of a small white candlestick with short shadows or tails followed by a large black candlestick that eclipses.

Engulfing Candlestick Pattern Forex Trading

Bullish Engulfing Pattern: This occurs when a candlestick, irrespective of its size, is followed by a larger candlestick that fully 'engulfs' the prior one. This green (or white) engulfing candlestick signals a price increase and typically appears after a downtrend. Bearish Engulfing Pattern: This pattern is the opposite of the Bullish.

WHAT ARE DIFFERENT TYPES OF CANDLESTICK PATTERNS? DCX Learn

The Bullish Engulfing pattern consists of two Candlesticks: Smaller Bearish Candle (Day 1) Larger Bullish Candle (Day 2) The bearish candle real body of Day 1 is usually contained within the real body of the bullish candle of Day 2. On Day 2, the market gaps down; however, the bears do not get very far before bulls take over and push prices.

Bearish Candlestick Patterns Scoopnest Riset

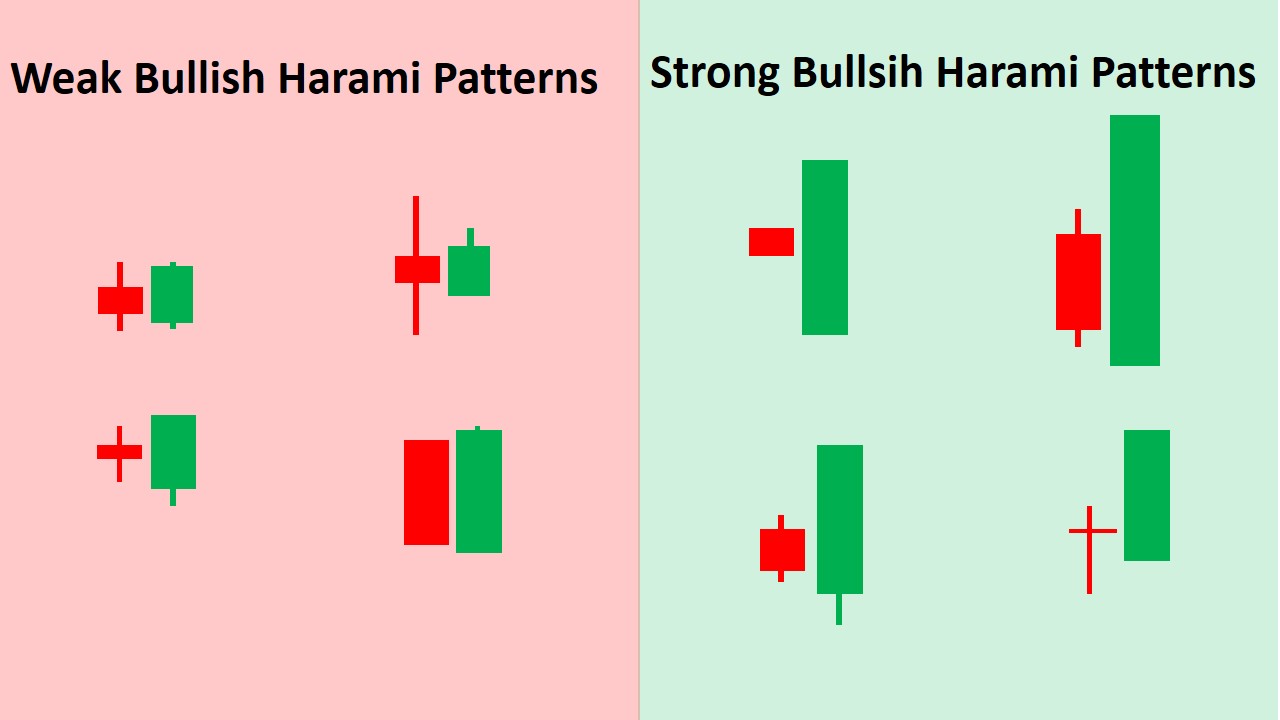

There are two types of engulfing candlestick patterns: bullish and bearish engulfing candlestick patterns. Bullish engulfing pattern. The bullish candle gives the best signal when it appears below a downtrend and shows a rise in buying pressure. The pattern mostly causes a reversal of a current trend.

Bearish Engulfing Candlestick Pattern

What is an engulfing candlestick pattern? Engulfing candlestick patterns are comprised of two bars on a price chart. They are used to indicate a market reversal. The second candlestick will be much larger than the first, so that it completely covers or 'engulfs' the length of the previous bar. There are two types: Bullish engulfing.

What Is Bullish Engulfing Candle Pattern? Meaning And Strategy

A bullish engulfing pattern consists of a small red candle followed by a larger green candle that completely engulfs the previous candle. A bearish engulfing pattern is the opposite, with a small green candle followed by a larger red candle. 🐳Step 3: Confirm the pattern. Before entering a trade based on an engulfing candle pattern, you.

Day Trading with the Bearish & Bullish Engulfing Pattern DTTW™

UnitedSignals Jul 8, 2023. 📚Engulfing candles are an essential feature of technical analysis in forex trading. An engulfing pattern happens when a larger candle engulfs the entire body of the previous candle, signaling a potential reversal of the current trend. Engulfing candles, which can be either bullish or bearish, are trusted by many.

Engulfing Candle Patterns & How to Trade Them

A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be.

Candlestick Patterns CIBC Investor's Edge

An Engulfing Candle is a candlestick pattern that occurs when a large candle "engulfs" the body of the previous smaller candle. The engulfing candle's body completely covers or "swallows up" the previous candle's body, indicating a shift in market sentiment. Types of Engulfing Candles (Bullish and Bearish)

There are four main types of double candlestick patterns bullish engulfing, bearish engulfing

Key facts. The engulfing candlestick pattern is a chart pattern consisting of green and red candles. In a bearish pattern, a red candle forms after the green one appears and absorbs it. In a bullish pattern, on the contrary, the green candle absorbs the red one. The engulfing pattern most likely signals a trend reversal.

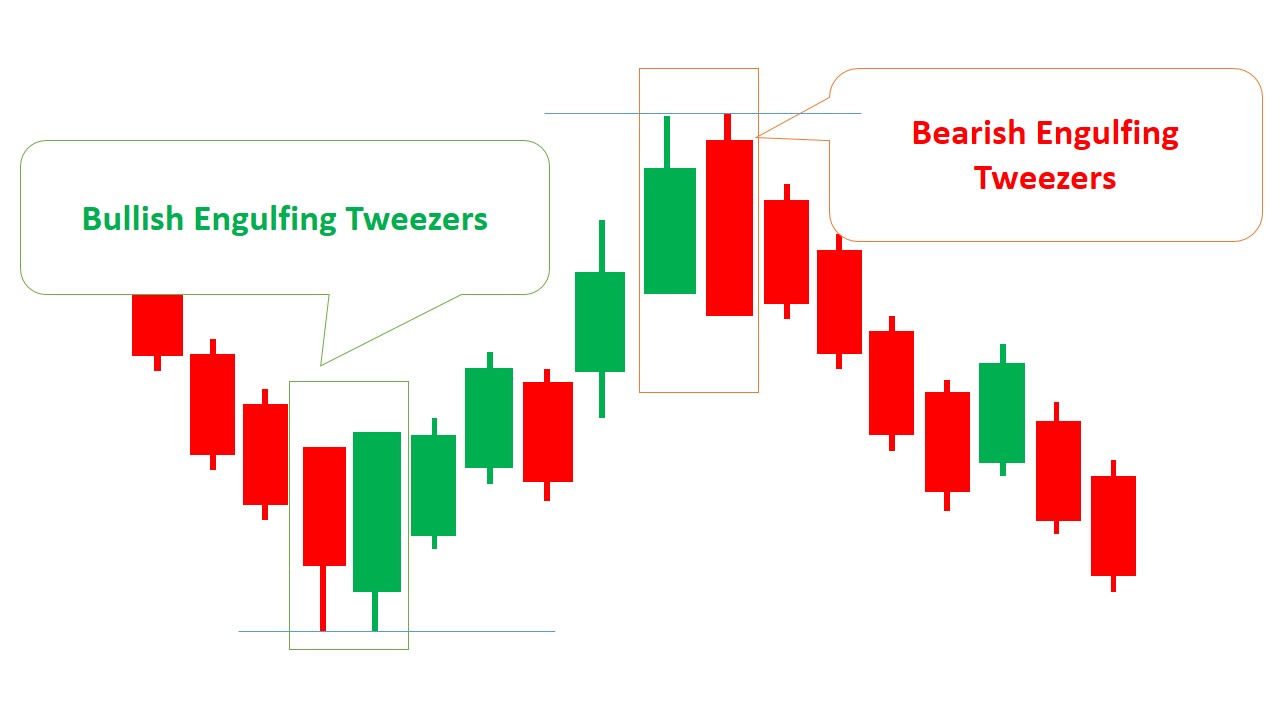

Tweezers Candlestick Patterns (Types, How to Trade & Examples)

Bullish Engulfing Pattern: A bullish engulfing pattern is a chart pattern that forms when a small black candlestick is followed by a large white candlestick that completely eclipses or "engulfs.

Engulfing Candle Patterns & How to Trade Them

What are the types of engulfing candlestick patterns? The engulfing candlestick pattern is classified into two types: bullish engulfing and bearish engulfing. Bullish engulfing occurs after a downtrend, signaling a potential reversal to the upside. Bearish engulfing occurs after an uptrend, indicating a potential reversal to the downside.